With the proposed legal framework, the government aims to enhance customer experience by ensuring transparency, consumer protection, and supervision.

On December 21, 2023, the Brazilian chamber of deputies approved to bring online sports betting under regulatory oversight in 2024. President Luiz Inacio Lula da Silva ratified the new regulatory framework, signing Bill 3,626/2023 into law on December 30. While brick-and-mortar casinos (including those on cruise ships) remain prohibited in the LATAM nation, online sports betting platforms and casinos will be able to apply for licensing from the federal government of Brazil to operate legally in the nation.

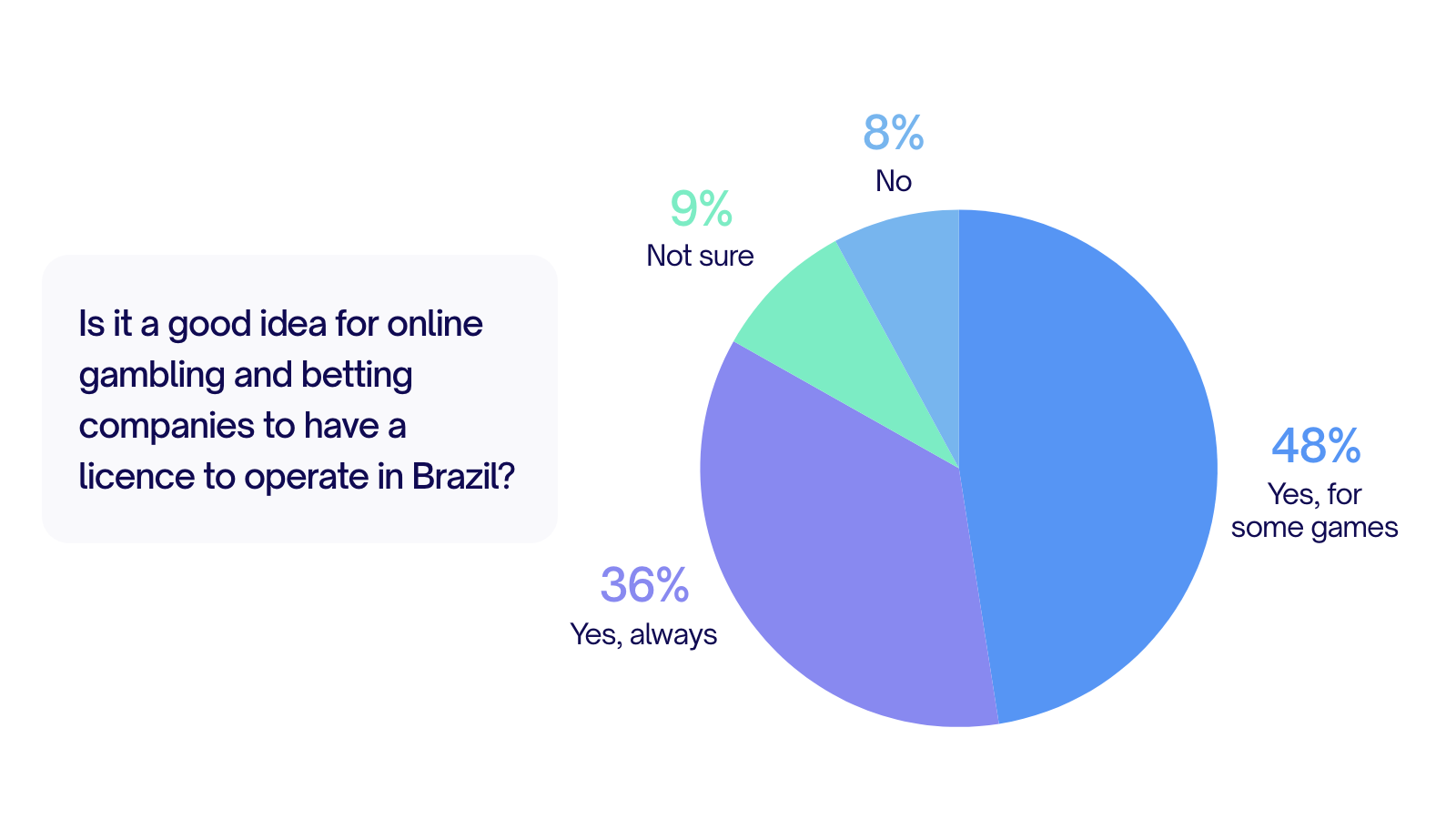

A survey conducted by Esse N Videri Media[1] on regular gamers in Brazil in February 2024 provided insights into market sentiment following this move to create a regulatory framework for online gambling. It revealed that 87% of the respondents believe that licensing, registration, and taxation are important for sports betting and iGaming providers. The respondents stated that this would lead to “wider public benefits,” including government oversight and market integrity. Gamers also believe that regulations will help combat “risky and addictive gambling behavior.”

Source: https://env.media/gambling-regulation-brazil-survey-insights

Here’s a deeper dive into the new regulatory framework and its implications.

What Changes Does the New Law Bring?

With the proposed legal framework for sports betting and iGaming, the government aims to enhance customer experience by ensuring transparency, consumer protection, and supervision. A license, once available, will be a differentiator for operators in the country who want to stand out and commit to consumer safety.

Additionally, the new law would bring good news, not just for online gaming enthusiasts but also in terms of creating jobs throughout the domestic ecosystem.

With this new law, companies can conduct fixed-odd betting operations, after receiving authorization from the Brazilian Ministry of Finance. Foreign operators wanting to operate legally in Brazil will need to establish a Brazilian subsidiary and apply for authorization. The Ministry of Finance is expected to release a regulatory framework, outlining the provisions under the new law, including authorization procedures and minimum eligibility criteria. For businesses already operating in the country, the government has given a minimum of six months to comply with the newly approved regulations, once they will be published.

Proposed Key Highlights of the New Law

- The Finance Ministry will set up an office responsible for registering and onboarding sports betting and iGaming operators in Brazil, with rigorous KYB and AML requirements, and analysis of business websites and documentation.

- This office will also be responsible for monitoring betting volumes and revenues of licensed operators to ensure greater oversight.

- Apart from establishing a subsidiary in Brazil, operators will require at least one Brazilian board member who holds a minimum of 20% of the company’s shares.

- Five-year licenses will be awarded with a payment of a maximum of R$30 million by the operator for up to 3 brands.

- Both operators and bettors will be liable to pay taxes. The proposed tax rate for operators is 12% of the “gross gaming revenue”[2], which is the revenue earned from all games played after subtracting any prizes paid to players and taxes levied on legal enterprises. Bettors will be taxed at 15% of their net winnings, which is a significant reduction from the previously proposed 30%[3].

- All bettors must be over the age of 18. Operators will be required to verify the identities of bettors through facial recognition technology.

- Online betting platforms will also be subject to PIS, Income Tax, Cofins, ISS, CSLL, and other taxes levied on businesses in Brazil.

- Operators will need to offer customers “self-exclusion windows” ranging from 24 hours to six weeks.

With the new law, consumer risks will be minimized, especially from the misuse of identities, and the use of synthetic identities to commit credit fraud. There will be alerts related to betting volumes and time limits, as well as debt control, steps essential to prevent gambling addiction. The new regulations are currently expected to come into force during the second half of 2024, giving existing and prospective operators in Brazil ample window to prepare and eventually comply with the new law.

More than 130 businesses[4] have already expressed an interest in applying for a license in Brazil. The future is bright for the Brazilian online gambling market, which is projected to reach a value of US$1.97 billion in 2024[5] and grow at a CAGR of 16.51% to reach US$3.63 billion by 2028.

Participate in the Future of Brazilian Gaming

Brazil is known as a nation of gaming enthusiasts. The new law is likely to bolster consumer confidence in the online sports betting and iGaming market, which signals a bright future for the sector. The time to expand to Brazil and reap the benefits of this massive opportunity is now. For a successful entry into this highly promising market, having the ability to offer the most popular local payment methods is indispensable.

One of the most popular payment methods in Brazil is PIX. Launched in November 2020, the online payment method has seen a meteoric rise, recording over 150 million users[6], both companies and private individuals, by mid-2023. The transaction value via this payment method rose 110% from 2021 to 2022, with registered users doubling their use of PIX from January 2022 to January 2023. According to an Ebanx study, released in January 2024, the instant payment system is expected to account for over 40% of Brazil’s online transactions by 2026[7].

With our proprietary and unique PIX solution, CommerceGate is a leading payments enabler in Brazil. We offer Payment Service Provider (PSP) and Payment Facilitator (PayFac) services to global entities wanting to expand to Brazil and the LATAM region. When you choose our PIX offering, you gain access to multiple benefits improving our merchants’ operational and commercial effectiveness, efficiency and Customer Lifetime Values (CLTVs):

- Instant access to funds in R$ (Brazilian Real), with no FX charges applied.

- Proprietary PIX flows covering Dynamic and Static QR codes.

- Average transaction time of only 3.7 seconds.

- Advanced PIX fraud prevention with a unique QR-code created for each individual user tax-ID.

- Fully transparent pricing tiers with no hidden fees.

- Transparent FX and overseas settlements.

We have close to two decades of experience in supporting business success through highly customizable proprietary solutions to streamline payments and reconciliation. Combined with a team and an office in Brazil, we are your payments partner to enter the market successfully.