Looking at Trends around Brazil’s Rapidly Evolving E-commerce such as a Sharp Rise in Real-Time Payments

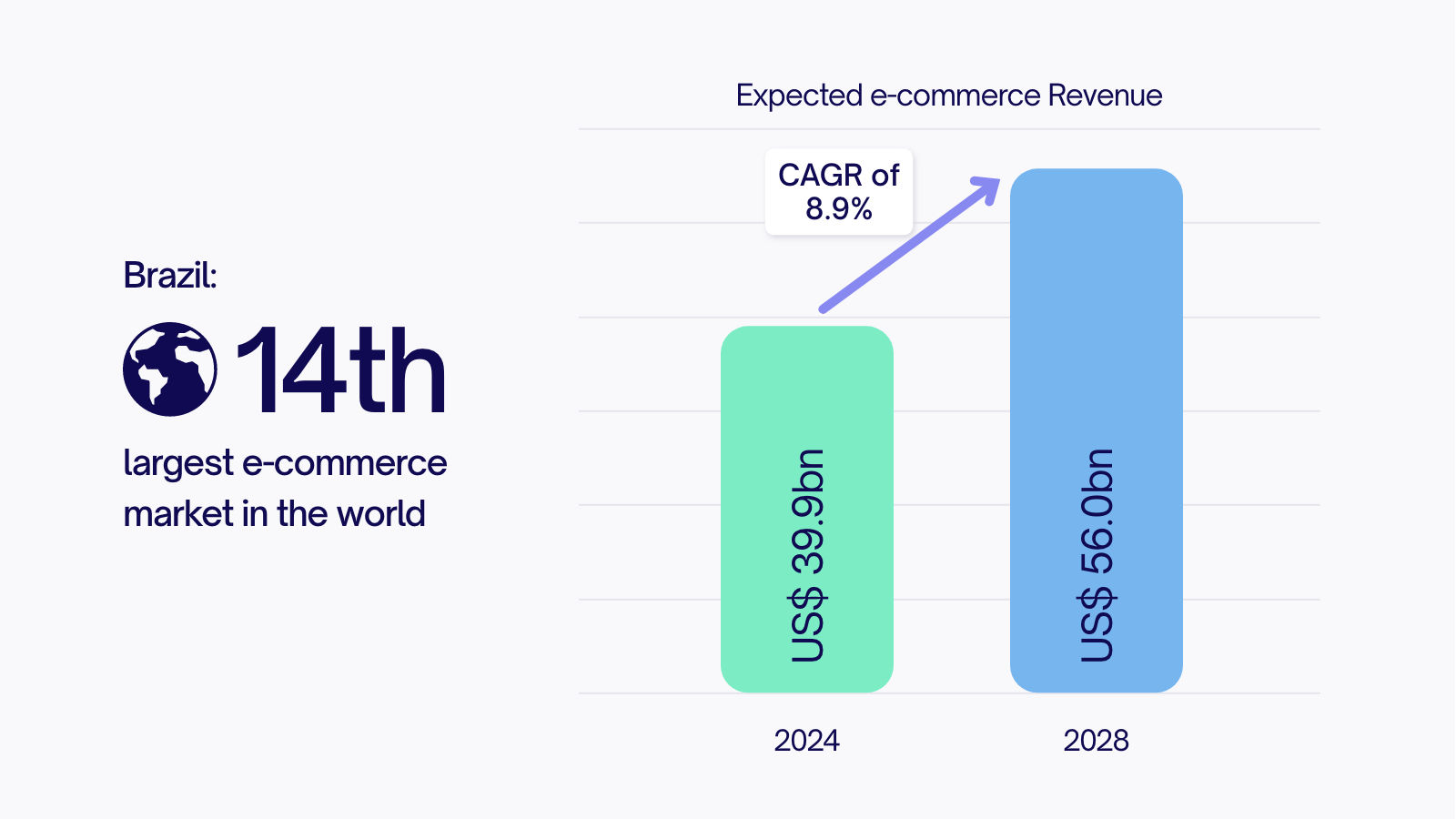

Both individuals and businesses in Brazil are open to adopting the latest technology. And when it comes to e-commerce, Brazilians don’t hesitate to explore multiple channels for their online shopping needs. From online marketplaces, such as Mercado Livre, Amazon, and Shopee, to social media platforms like Instagram and Facebook. Little wonder then that Brazil ranks as the 14th largest e-commerce market in the world, expected to generate revenue of US$39.9 billion in 2024 and growing at a CAGR of 8.9% thereafter, to reach a market volume of over US$56.0 billion by 2028.

For businesses that wish to capitalize on this massive opportunity, making the most popular products available is only part of the story. Brazilians also have their favorite payment methods that they seek to transact through while placing online shopping orders. One of the most popular payment methods is PIX, an instant payment system that is projected to account for over 40% of the country’s online shopping by 2026.

But, as we said earlier, Brazilians are open to new technologies that make life easier. And the penetration of smartphones is increasingly making the country a mobile-first one. So, what else should you know about e-commerce trends in Brazil to establish a strong footprint in the LATAM nation? Let’s take a look in this article, and if you want to get some personal insights into the opportunities for your brand in Brazil, jump to the bottom of this article for your chance to meet our CCO, Paul Barclay at the UK’s Pay360 event this March 19-20.

Source: https://ecommercedb.com/markets/br/all

Sharp Rise in Real-Time Payments

Even after four years of the pandemic, which saw the launch of digital payment methods like PIX, Brazil continues to see the evolution of QR codes, Near Field Communication, and digital wallets for e-commerce payments. Launched in 2020 by the Central Bank of Brazil, PIX saw meteoric growth, accounting for BRL 17 trillion ($3.4 trillion) in payments and 42 billion transactions in 2023. Continued innovations have played a major role in this widespread acceptance. In fact, Brazil is way ahead of the US and Europe in the use of digital wallets and real-time payments. This trend is only expected to strengthen going forward.

Payment Optimization to Minimize Cart Abandonment

While online retailers report that $260 billion in lost sales (due to cart abandonment) can be recoverable by optimizing payment performance, 82% of these retailers struggle to identify the cause of payment failures. To optimize their sales, e-commerce businesses are increasingly expected to turn to payment performance optimization to minimize sales loss due to payment issues. Some of the most common reasons for cart abandonment in Brazil include payment complexity, lack of funds, the absence of personalized, localized payment options, and security concerns. False declines are another major reason for lost sales.

The best course of action is to partner with a payment solutions provider and payment facilitator with deep insights into the Brazilian market. Such a partner can ensure accurate identification of reasons for payment failure while maximizing transaction security and speed, reducing downtime risk, and preventing churn due to outdated customer payment details.

A Mobile-First Approach

In Brazil, 70% of e-commerce volumes are accounted for by mobile devices. However, a unique characteristic of Brazilian shoppers is that while they do their research and pay for shopping via digital means, they often pick their orders up from brick-and-mortar stores. Therefore, providing a unique customer journey across channels is vital to success. This also means that brands will increasingly focus on providing the most preferred mobile payment methods, including payment apps and digital wallets.

So, if your e-commerce platform isn’t optimized for mobile shopping and payments, the time to implement a mobile-first strategy is now. Make sure you also add features that enhance user experience, such as one-click checkout, personalized recommendations, and mobile wallet integrations. Plus, an omnichannel payment strategy will create consistent cross-channel customer experiences.

The Rise of Account-to-Account Payments

The global A2A payments market is projected to expand at a CAGR of 13% to reach a value of US$850 billion by 2026. This indicates that traditional e-commerce payments are poised to face disruption. Brazil is among the leaders in the rise of A2A payments, along with the Netherlands, Poland, India, and Malaysia. This payment option is expected to receive a boost from the growing acceptance of open banking, real-time payments, and supportive regulations.

The most popular payment method in Brazil is also a real-time A2A transfer option – PIX. Integrating PIX is a great option to lower payment acceptance costs, improve cash flow management, and ensure zero chargebacks. You can also consider driving repeat purchases and enhancing long-term value for customers by linking loyalty programs to A2A payments and, of course, by implementing CommerceGate’s proprietary PIX solution with static QR codes.

Expand Globally via Hyper-Localization

Did you know that you could lose 45% of shoppers if you don’t offer their preferred payment method? Hyper-localization is the best way to cater to regional customer preferences and needs. In Brazil, you might want to explore digital wallets, instant bank transfers, and BNPL options, apart from credit/debit cards.

Choose a payment solutions provider with relevant on-the-ground experience in the market you wish to enter or expand in. They will be able to guide you regarding local payment preferences, apart from supporting you in understanding cultural differences in online shopping. Plus, integrating local payment channels lowers processing costs and increases authorization rates.

Ease Your Entry into the Brazilian Market

Brazil offers an excellent opportunity for e-commerce enterprises to reach a wide audience. The key is to understand the preferences of the Brazilian consumer, including channels to target. CommerceGate has vast experience in supporting payment enablers and e-commerce merchants with the most suitable payment solutions for the Brazilian market. Our proprietary PIX solution offers unique benefits, improving your operational and commercial effectiveness via:

- Instant access to funds in Brazilian Real, with no FX charges applied.

- Proprietary PIX flows covering Dynamic and Static QR codes.

- Average transaction time of only 3.7 seconds.

- Advanced PIX fraud prevention with a unique QR code created for each individual user tax ID.

- Fully transparent pricing tiers with no hidden fees.

- Transparent FX and overseas settlements.

Our CCO, Paul Barclay, is attending Pay360, the largest event for the payments ecosystem. The event will be held on March 19 and 20, 2024, at ExCeL, London, the UK.

Paul will be present on both days to showcase our expertise in the LATAM payment landscape, how we can support your business with our local team and office in Brazil, as well as our deep understanding of local regulations, backed by a best-in-class customer success team.