Cultural shifts, technology adoption, and rising awareness of FX trading are driving the growth of e-FX in LATAM.

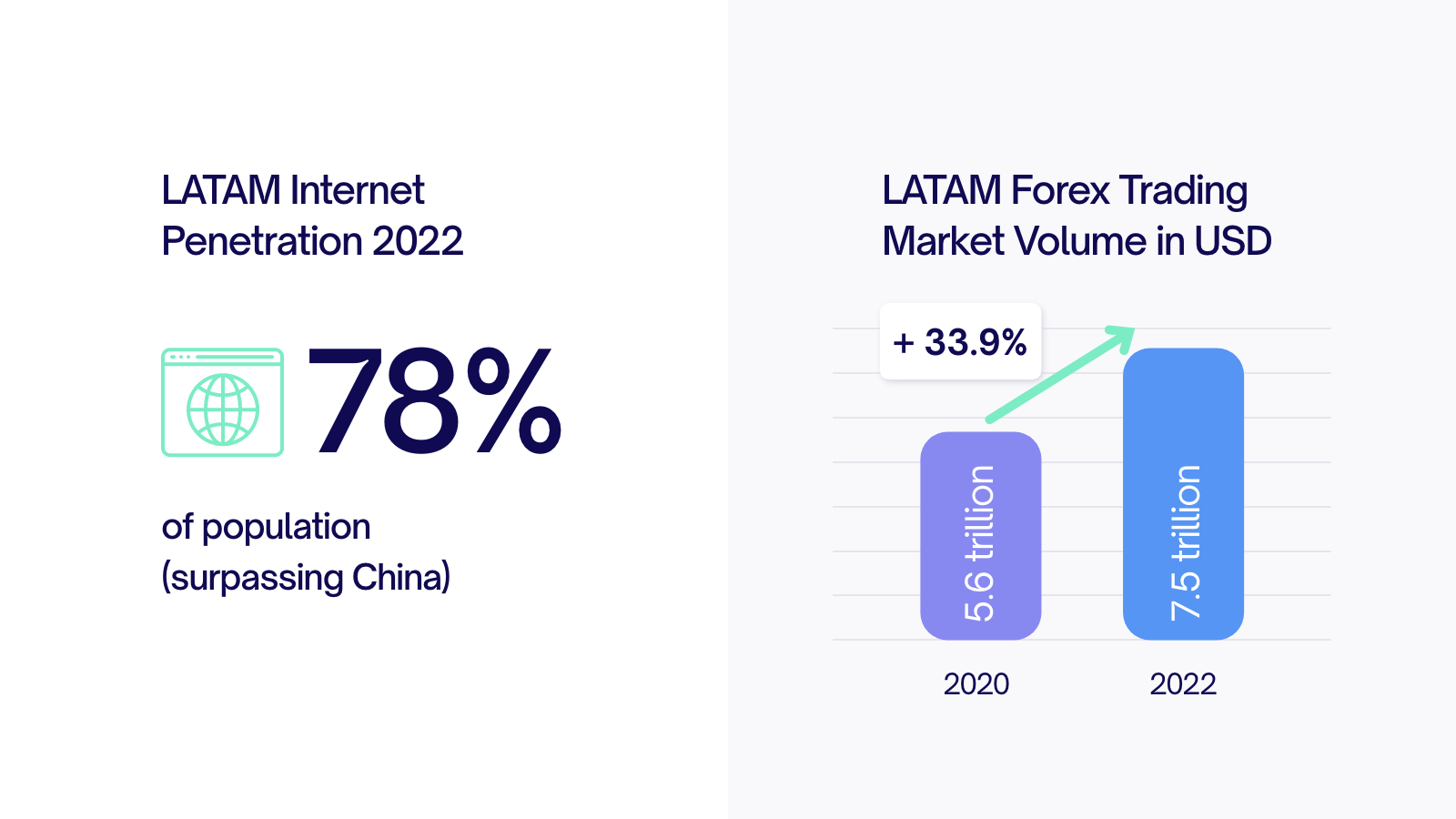

Electronic trading has seen a significant rise in LATAM in recent years, witnessed by the growth of the region’s forex market and strengthening regulations. Countries like Brazil, Colombia, Mexico, Chile, and Peru have taken the lead in forex trading (FX e-trading). The diverse benefits of e-FX led to a 33.9% increase in market volume from 2020 to 2022 to reach a valuation of $7.5 trillion[1].

As early as 2020, 360t.com, the Deutsche Börse Group’s global FX unit, highlighted that the FX industry in Latin America was “gearing up for a decade of growth”[2].

Source: https://docsend.com/view/48rpy858p2kqy479

Factors Propelling the Growth of forex trading in LATAM

Cultural shifts, technology adoption, and rising awareness of FX trading are driving the growth of e-FX in LATAM.

Significant Economic Growth

If Latin America were a single country, its GDP of $6 trillion for a population of 660 million[3] would make it the third-largest global economy. The region is expected to grow 2.1% in 2024[4], as it adopts strategic and sustainable development policies. Monetary easing, cooling inflation, and nearshoring investment[5] are also expected to support the region’s growth.

Prospects of economic growth are bright, with the expansion of global trade (discussed further below). Green growth and digitalization are expected to create further opportunities for growth. Additionally, the expansion of health-related manufacturing and sustainable tourism are likely to propel the economies in LATAM. The large human capital in the region adds to its strategic advantage, bringing educational, employment, and entrepreneurship opportunities.

Rapid Digitalization

“Digital democratization,” as Atlantico’s Latin America Digital Transformation Report mentions, has played a significant role in the advancement of e-FX in the region. Internet penetration reached 78% in 2022[6], surpassing China[7] and growing 35 basis points from the previous year. A key driver of this massive growth is the doubling of 4G implementation[8] across the region from 2018 to 2023. LATAM is now rapidly progressing towards 5G. The rise in internet penetration has been attributed to greater smartphone adoption by the lower and middle-income groups. The 5G transition is expected to bolster the demand for forex trading, from both institutional and retail investors.

Due to the younger population, many countries in the region are poised to also see eCommerce growth on par with the US. Moreover, Latin Americans dominate in terms of the use of popular social media and OTT media platforms, such as Instagram, Facebook, TikTok, YouTube, and Netflix. This has helped raise awareness about financial planning and money management, along with the opportunities for e-FX. The flexibility and accessibility offered by mobile apps are expected to further propel the demand for mobile-based forex trading solutions.

There is a clear rise in the demand for digital investment platforms in the region, as the wealth management sector becomes increasingly digitalized. Plus, the use of AI and Machine Learning (ML) for enhanced decision-making and automated trading and hedging strategies, helps optimize market opportunities, which is expected to continue to attract traders to e-FX.

The Growing Middle Class

The digital transformation of LATAM, clubbed with access to high-speed internet, has bridged the gap in access to financial services between the middle and low-income groups. In addition, several low-income groups have climbed the income ladder due to the economic expansion in the region. Consequently, the middle class in the region has grown to a whopping 30%[9], igniting interest in wealth accumulation and long-term financial planning. Inflationary instabilities are also encouraging people to explore diverse avenues of investment. Another key propeller of the growth of e-FX is the recognition of the opportunities and value of electronic trading as a source of income generation.

Further, with the growing awareness and demand for FX trading, the focus of local banks and financial service providers has also shifted to improving customer experiences by reducing costs and boosting operational efficiency. Retail customers increasingly expect better pricing, ease of use, and lower spreads. While asset and hedge-fund managers focus on increased transparency and expedited trade execution, automated hedging and better access to the offshore markets are also raising demand for e-FX.

Several other advantages of e-FX are also attracting new traders in large numbers. These include:

- Provable best execution.

- Price transparency.

- Ease of adherence to code-of-conduct.

- Efficient trade confirmation and settlement.

Growth of International Trade

Accounting for 17.7% of the world’s global food production[10], Latin America was the largest net exporter of agricultural produce in 2022. The region is expected to multiply this growth to meet rising global demand and be a major participant in the global multilateral trade systems by 2032. Owing to its neutrality to both China and the US, the available market remains vast for LATAM.

Latin America also leads in the global supply of metals and ores. Considering the emphasis on Net Zero emissions and the transition to green energy sources, the region will maintain its dominance as the largest exporter in this segment as well.

Global banks, like Citi, have invested in a regional FX services provider to make it the region’s first FX fintech to receive investment from a world leader. Plus, the strengthening of the local currencies, such as the Brazilian Real and Mexican Peso, has encouraged people to explore the FX markets.

Get Ready to Expand into Latin America

With the opportunities presented by LATAM, it’s only natural for businesses to want to expand to the region. To adequately leverage the opportunities of the expanding e-FX market here, it is paramount for brokerages, banks, and financial institutions to facilitate digital money movement through the most popular methods in the region.

This is where the expertise of a leading payment partner with premium security, transparency, and scalability can help maximize opportunities offered by the expanding forex trading sector in LATAM. Being a fully authorized payment service provider and payment facilitator with a local team and offices in Brazil, along with being licensed by the Bank of Spain. Commercegate maintain the highest standards of risk management, segregated client funds, trust, and respectability through:

- Transparent and trackable liquidity streams.

- Expedited fund settlement.

- Ease of adherence to code-of-conduct.

- Superior customer services.

- Customized business solutions.

We support financial organizations in providing superior trader experiences with:

- Top-tier security.

- Efficient trade execution.

- High authorization rates.

Specifically for Brazil, Latin America’s biggest economy, CommerceGate’s PIX Payment Platform provides the optimal functionalities for agile forex trading:

- Instant access to funds in Brazilian Real, with no FX charges applied.

- Proprietary PIX flows covering Dynamic and Static QR codes.

- Average transaction time of only 3.7 seconds.

- Advanced PIX fraud prevention with a unique QR code created for each individual user tax ID.

- Fully transparent pricing tiers with no hidden fees.

- Transparent FX and overseas settlements.