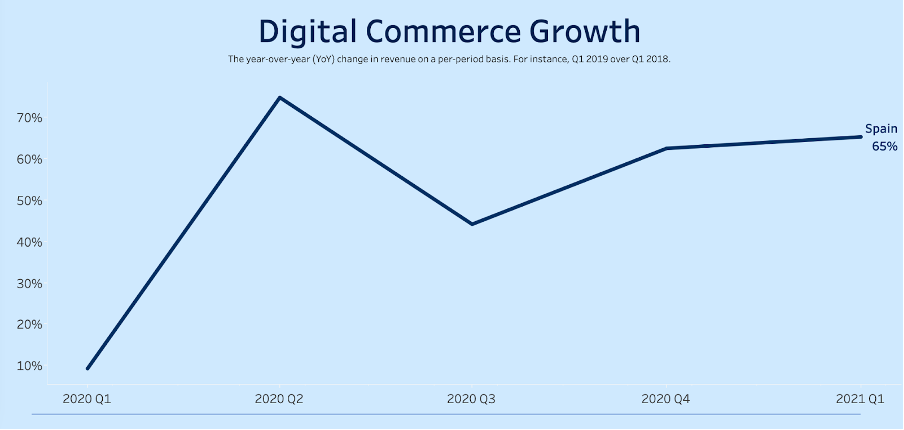

The ecommerce growth that we saw in the last year has been unprecedented, both in terms of revenues and number of users. The pandemic accelerated a global shift towards shopping online that was already undergoing. In Spain, the growth has been impressive, with a 65% increase in online sales just in the last quarter.

At a global level as well the ecommerce market reached new highs. In fact,

in 2020, retail e-commerce sales reached approximately 3.5 trillion euros. A growth that is expected to continue, with revenues projected to reach 4.4 trillion euros in 2022.

Chart source: Salesforce Shopping Index.

The impact of Covid-19 on the ecommerce market

The pandemic had a significant impact on people’s lives, boosting digital transformation and digital adoption. The ecommerce market evolved into something significantly broader, with new companies entering the space, new customers who started to shop online, and a wider variety of products available. With non-essential physical stores closed for months, the possibility to shop online has been fundamental for both people and businesses.

There are ecommerce segments, like the services for the elderly, and products, like groceries, that experienced more increase. But it’s the whole market that has accelerated. In general, a larger and more heterogeneous customer base, with different needs, brought the online market to shift away from luxury towards the goods and services used every day.

PSD2, open banking and ecommerce payments

The European Union’s revised Payments Service Directive (PSD2) came into full force in January 2018 and implied a stepping stone toward an open banking scenario. A new directive introduced to break the banks’ monopoly, forcing them to open up their data and make it shareable through open application programming interfaces (APIs). And ultimately to make payments and financial services more innovative, ensuring a level playing field for payment service providers (PSPs) and give more choice to consumers.

PSD2 also meant a major innovation for ecommerce and the way payments’ work. Practically speaking, there is now the opportunity to license third-party providers (TPPs), to be easily integrated with open APIs, and initiate payments from one account to another with direct bank transfers.

Open banking represents an important chance for all the market participants. It gives merchants the opportunity to partner with a licensed payment service provider, bypass intermediaries, and eliminate interchange and transaction fees – with the result to substantially reduce the expenses related to online transactions and reduce the problem with chargeback disputes.

Moreover, it offers a faster, cheaper and safer experience to consumers – making the whole payment process more transparent and giving them more choice.

SCA, security and checkout process excellence

There is also another piece of PSD2 that just recently entered into effect: the strong customer authentication (SCA).

With SCA, the aim is to reduce fraud and make online shopping more secure for consumers by adding an extra layer of authentication in the checkout process. Something that goes hand in hand with the introduction of a new authentication tool called 3DSecure 2 that makes it easier to collect the SCA required information.

For ecommerce operators, it becomes fundamental to comply with the new regulations and guarantee maximum security for the consumers while keeping the whole checkout process as smooth as possible.

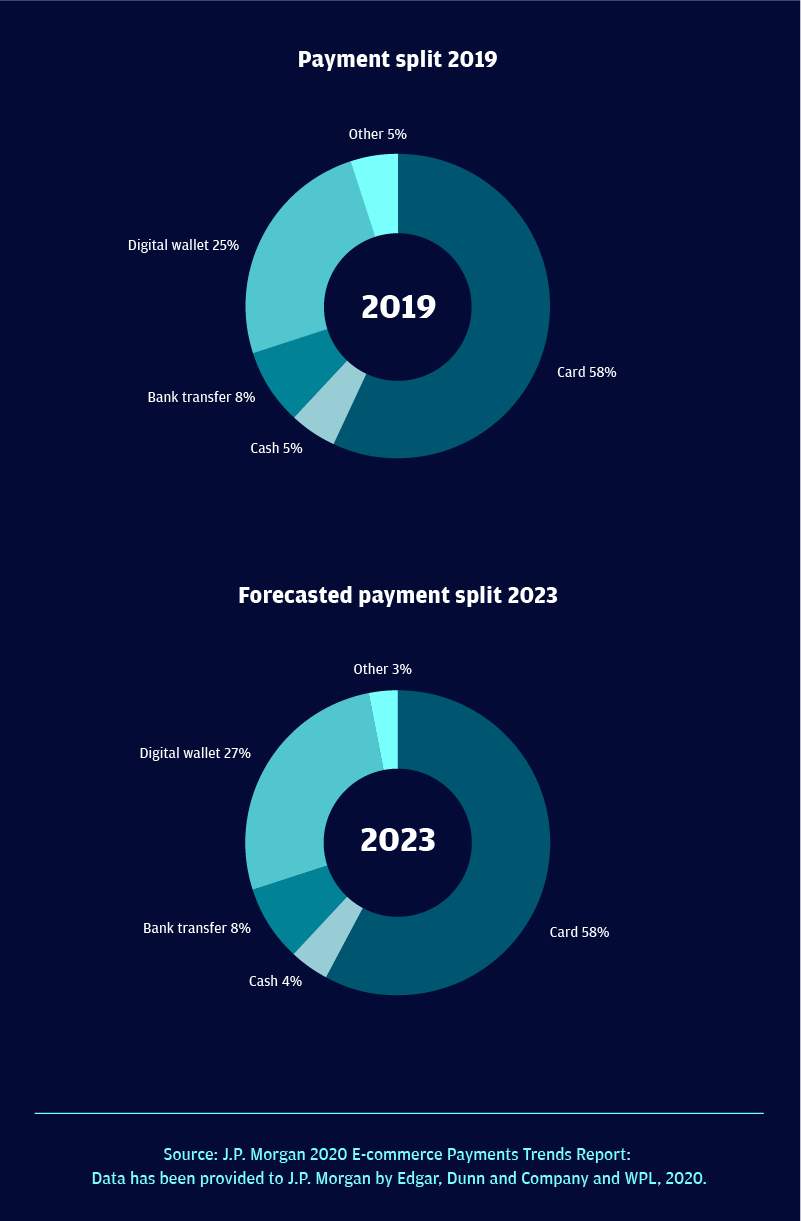

Preferred online payment methods for Spanish consumers

Credit and debit cards payments are still the most popular way (48%) for ecommerce payments in Spain. But that’s a percentage set to decline substantially in the upcoming years, as digital wallets and direct bank transfers are becoming increasingly popular.

Chart source: J.P. Morgan - 2020 E-commerce Payments Trends Report.

To be more specific, digital wallet use is expected to increase at a compound annual growth rate of 35% to 2022. However, are the bank transfer payments, thanks to the open banking dynamics explained above, that are growing at the fastest pace, with a 50% compound annual growth rate to 2022. And this is also connected to another service related to payments that saw a rapid increase in popularity in recent years: buy now, pay later (BNPL).

BNPL is a system offering consumers the possibility to buy things online on credit and then pay them back over time. Given the quick increase in popularity, card brands are now also incorporating that into their offerings.

Conclusion

The potential for e-commerce in Spain creates vast opportunities for SMEs, multinationals and startups. The shift in demand from brick-and-mortar retail to ecommerce recently saw a decisive acceleration. And the change in shopping preferences that occurred in the last year is essentially here to stay.

It’s an occasion that is just for the companies ready to innovate and take advantage of technology and the new possibilities linked to open banking, to introduce a new range of value-added services.

What we have seen so far is just the start of a major transformation that was already underway. There’s still time to get in, but the time to act is now.