Brazil presents an exciting opportunity for FX businesses to expand along with giving further strategic expansion opportunities into other LATAM countries.

Forex trading has been gaining popularity in Brazil in recent times. There are several reasons for this, including the transition of the forex market from being strictly monitored by Banco Central do Brasil (BCB) to a more liberal regulatory environment.

However, Brazil’s rules for forex trading are still a bit confusing. So consumers wanting to trade FX in Brazil have to be cautious and work with established and trusted partners. The good news is that there are many established international brokers working in Brazil, licensed from recognised authorities such as the FCA in the UK, CySEC in Cyprus, and ASIC in Australia. Now, the only factor that stands in the way of growth is the number of brokers functioning in the country.

Brazil presents an exciting opportunity for FX businesses to expand along with giving further strategic expansion opportunities into other LATAM countries.

Source: https://www.fx-markets.com/trading/7949010/latam-electronification-a-market-stuck-in-the-past

Why Would Brokers Want to Expand into Brazil

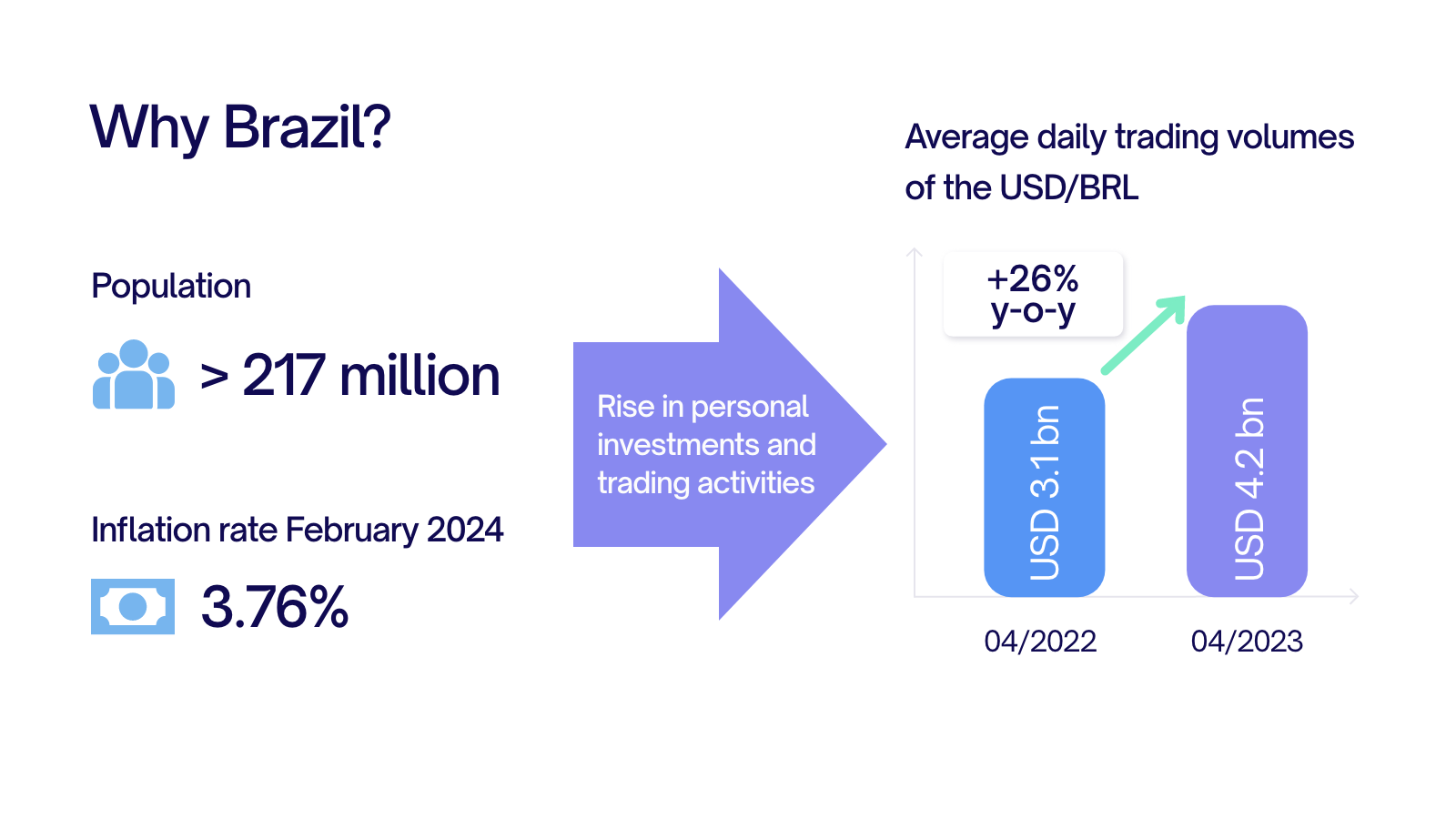

With a population of over 217 million[1] and an inflation rate of 3.76%[2] as of February 2024, the largest economy in LATAM is seeing a rise in personal investment and trading activities. As the region undergoes a digital transformation, individuals are increasingly exploring forex trading as a viable avenue to enhance their financial prospects and diversify their investment portfolios. As a result, the average daily trading volumes of the US dollar/Brazilian real via online platforms increased 26% y-o-y to USD 4.2 billion[3] in April 2023.

Brazil has a well-established capital market and is a major financial hub of Latin America. Plus, it is home to the Bolsa de Mercadorias & Futuros (BM&F) and São Paulo Stock Exchange (BOVESPA), the largest stock exchange[4] in the region. In addition, the abundant natural resources and growing population of the region are attracting FX businesses seeking to expand into new markets.

The rise of forex trading is being driven by the supportive measure of the BCB, which is focused on modernizing Brazil’s forex regulations. For example, the central bank has been working on a bill that aims to extend the convertibility of the Brazilian real[5] by lowering barriers to foreign business and updating the old and cumbersome forex law. Not only can brokers with a license from the Comissão de Valores Mobiliários (CVM) offer forex trading services in Brazil, but also those licensed by Belize’s International Financial Services Commission (IFSC).

A key opportunity offered by Brazil’s FX market is the ability to trade multiple currency pairs. Traders can choose from major forex pairs, such as the GBP/USD, EUR/USD, and USD/JPY, as well as minor and exotic pairs. The nation’s forex market is known for its high liquidity and ample volatility[6] to offer abundant trading opportunities.

The Brazilian capital markets also offer opportunities to invest in other financial instruments, including commodities such as oil and gas, precious metals, sugar, coffee, and soybeans. These commodities can be traded in the form of ETFs or futures contracts. The nation’s stock market also offers viable investment opportunities, given the wide range of stocks across numerous sectors listed on the exchanges.

Best Practices to Expand FX Businesses to Brazil

LATAM has grown into one of the largest fintech markets in the world, with Brazil leading the charge with more than 750 companies[7]. The 70% internet penetration in the region has been one of the major drivers of this growth. The increasing use of smartphones and rising internet penetration will continue to drive the demand for forex trading in the region. Fintech-friendly regulations and supportive government policies are other reasons that make Brazil an attractive destination for forex businesses.

Here’s a look at some strategies that can ease entry into the Brazilian market.

Navigate Compliance

The capital markets in Brazil are regulated by the CVM. Foreign FX businesses entering the country must accept deposits in local currency and also offer web resources in both Portuguese and English. In addition, you will need to provide identification data for the founders[2] or leaders of the business, including documents confirming that these persons have adequate professional knowledge of the market in which the business will operate. Your business will also need to obtain a Cadastro Nacional da Pessoa Jurídica (CPNJ) number, a 14-digit identification number issued to entities, such as companies, foundations, and partnerships.

KYC regulations for onboarding customers are also stringent and include the full name, address, date and place of birth, nationality, and the Cadastro de Pessoa Física (CPF) number. This is an 11-digit number, issued by the country’s inland revenue service. It is essential for conducting monetary transactions in Brazil, including paying taxes.

It is also important to know that Consumer Protection Agencies (PROCONs) in Brazil are responsible for investigating misconduct associated with consumer protection, especially if a consumer lodges a complaint. These regulators have the power to impose administrative penalties if a service provider is found guilty of violating consumer interests.

Customize Your Platform

To successfully enter any market, you need a customized approach. However, for a market like Brazil, you will need to go the extra mile to fulfill all the local legal requirements and meet customer expectations. For example, Brazilian customers prefer WhatsApp as the main customer support channel. So, make sure you incorporate local means of customer support, including the preferred channels, to address customer needs and issues effectively.

Apart from this, make sure your platform offers the various financial instruments and asset classes that Brazilians trade most often. This includes not just access to the most popular forex pairs, including the USD/BRL, but also commodities, such as oil, gold, and silver.

Also, Brazilian traders might want to fund their trading account in the Brazilian real via their preferred payment method. So you also need to integrate the most popular payment solution in the country, PIX.

Choosing the Right Payments Partner

Since monetary transactions lie at the heart of any FX business, choosing a trusted and experienced payments partner is the cornerstone of seamless, customer-focused, and compliant operations in Brazil. With years of experience providing state-of-the-art payments solutions in LATAM, especially Brazil, CommerceGate has deep insights into what forex platforms need to expand into this market.

Our highly customizable PIX Payment Platform eases your entry into Brazil. With a fully authorized service provider at your side, you can be sure of:

- Customized business solutions.

- Proprietary PIX flows covering Dynamic and Static QR codes.

- Advanced PIX fraud prevention with a unique QR-code created for each individual user tax-ID.

- Top-tier security.

- Efficient trade execution.

- High authorization rates.

- Expedited fund settlement.

- Superior customer services.

We also support you in ensuring KYC compliance, allowing you to lock PIX payments to specific Brazilian CPF numbers to authenticate the identity of customers depositing funds on your platforms. This is a unique feature offered only by CommerceGate, ensuring that your business stays protected at all times. We also give you the option to receive customers’ KYC data via callbacks, including the CPF, the full name of the customer, and the bank details of every PIX payment or withdrawal made.